Confidence among Egyptian consumers has generally stabilized since its currency was devalued at the end of last year, and there are two reasons for the stabilization — inflation is slowing and consumers have adjusted their spending.

Confidence among Egyptian consumers has generally stabilized since its currency was devalued at the end of last year, and there are two reasons for the stabilization — inflation is slowing and consumers have adjusted their spending.

The evidence of the strengthening optimism about the economic landscape across Egypt is evident among consumers, as the country reported a consumer confidence index level of 80 in second-quarter 2018, according to the Conference Board Global Consumer Confidence Survey, which is produced in collaboration with Nielsen. The index level for the period reflects an increase of 16 points since fourth-quarter 2016, which is when the devaluation occurred.

As a result of the devaluation, shoppers in Egypt were faced with a new normal to adapt to. With a greater focus on their personal finances, they sought out better deals, no matter where they were, began trying other brands to save money and shifted to different package sizes and formats.

Across the board, consumers had one primary goal: Get the most value for their money by avoiding waste.

More Store Visits Smaller Baskets

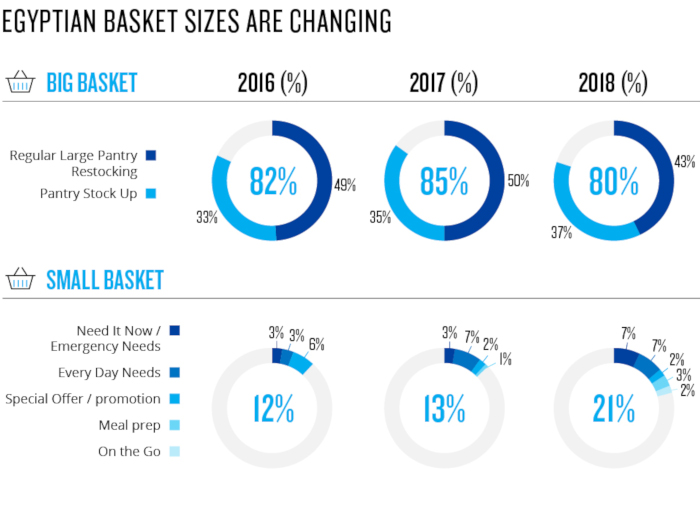

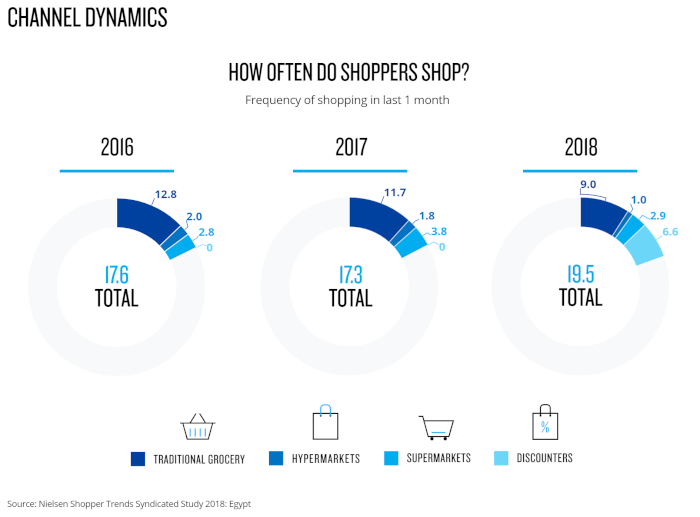

In 2018, Egyptian shoppers are buying less on each trip, and they’re waiting longer for big pantry stock-up trips, filling in the gaps by making more frequent restocking and ‘need-it-now’ trips. A year ago, Egyptian shoppers were more likely to visit a supermarket up to four times a month, and/or a hypermarket almost two times a month. This year, supermarket visits have dropped to three, with trips to hypermarkets down to one.

Traditional trade outlets have also been affected, with trips to them down from 11 visits to nine. Today, a lot of traffic is now headed toward discounters, with consumers opting to visit them almost seven times per month.

The revised shopping behavior has also impacted how consumers pay for their trips. More consumers today are paying in installments to make their shopping more affordable while ensuring that all products purchased are used up before having to re-stock.

Opting For Tried & True Over Promotions

There was a time after the devaluation when the shoppers followed promotion, but they have since shifted to favor brand loyalty over pricing.

According to Nielsen Shopper Trends Syndicated Study 2018: Egypt, only 9 percent of respondents say they are willing to change stores based on which one they think has the best promotions that trip, down from 18 percent the previous year. Moreover, the report revealed that 21 percent of consumers would only buy promotions when they already like the brand, up 17 percentage points from the previous year.

When a product doesn’t work, consumers view them as a waste of money. So it’s not surprising that shoppers have decided to stick with tried and true products that they can rely on, even if they have to go for smaller sizes bought on a more frequent basis.

Consumers Are Sticking To The Stores They Know

A new store holds the excitement of discovery, and on the path to finding the product you actually want, a number of unplanned items might cross your path, and eventually make their way into your basket. That’s what 85 percent of Egyptian shoppers are trying to avoid by sticking to the stores they know by visiting only one store.

In reality, the Shopper Trends tracker shows that these shopping strategies or habits were in the making for a few years but have become more concrete very recently. It can be concluded that Egyptian consumers are reaching a state of normalization, despite continued rising costs and lower spending power.

It’s no longer time to experiment. In fact, other recent studies have shown that along with the need for value they are on a quest for convenience. This calls for an urgent need for manufacturers to revisit design and promise, and for outlets to accommodate for comfort and familiarity.