National Bonds has launched a nationwide campaign to encourage UAE residents to identify personal challenges to saving in a bid to instill a culture of saving across the emirates.

National Bonds has launched a nationwide campaign to encourage UAE residents to identify personal challenges to saving in a bid to instill a culture of saving across the emirates.

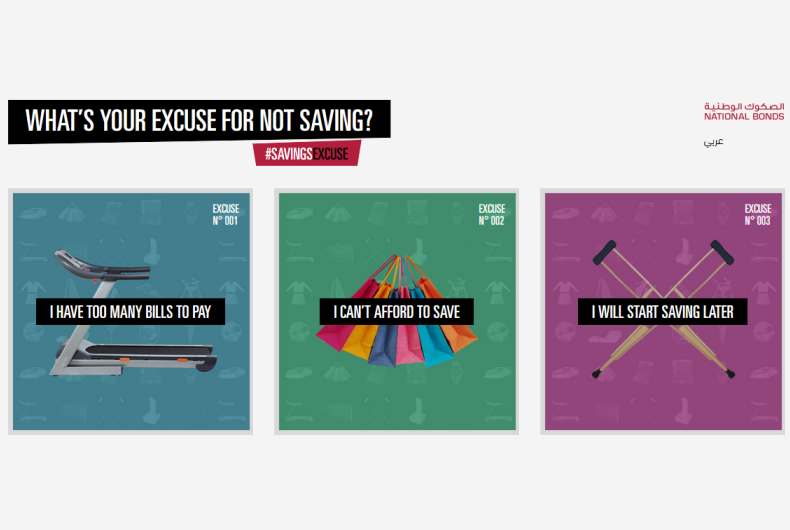

Using digital media and OOH platforms, National Bonds is calling on consumers to open up about their financial excuses using the hashtag #SavingsExcuse.

“We have long supported the Government’s ambition to increase financial literacy and savings to achieve a healthy and secured financial future for individuals and their families. Most people know they should be saving; the hard part is knowing where to start,” said Mohammed Qasim Al Ali, CEO of National Bonds.

He explained that the #SavingsExcuse campaign will help people identify what exactly prevents them from putting money aside and help them realize, even the smallest change in spending habits can help achieve financial stability in the long term.

The United Arab Emirates has become a dream destination for many, but the transient nature of the emirates makes it easy for residents to forget about saving.

A recent survey by National Bonds highlights an overall lack of awareness when it comes to financial planning. The Financial Planning Survey found 69 percent of respondents in the UAE were unsure of the steps needed to achieve their financial goals. Interestingly, of those surveyed, 53 percent were most interested in receiving advice relating to retirement planning. This was the case across the four audience segments surveyed including Arab (53%), Asian (57%) and Western (64%) expats.

UAE Nationals, however, were more concerned with advice pertaining to financial health (48%) followed closely by retirement planning (41%).

“It is not surprising to see retirement planning is a key concern for UAE residents. While people save for a multitude of reasons including weddings and travel, retirement planning is unavoidable. This is why this campaign is so important, it is absolutely vital people understand what it is that is preventing them from saving so they can overcome it. The next step is to create a savings goal and put a plan in place to achieve it,” Mr Al Ali concluded.