As markets in Africa depict all traits of becoming digital first on various counts, social media in many ways has created a cycle that has driven connectivity, leading to further growth of social media channels.

A closer look at numbers from Global Web Index shows that digital, led by smartphone penetration, is well on its way to become mainstream in Africa, and in the new connected reality, brands cannot ignore the power and influence that social media commands.

Facebook Dominates Social Media Across Africa

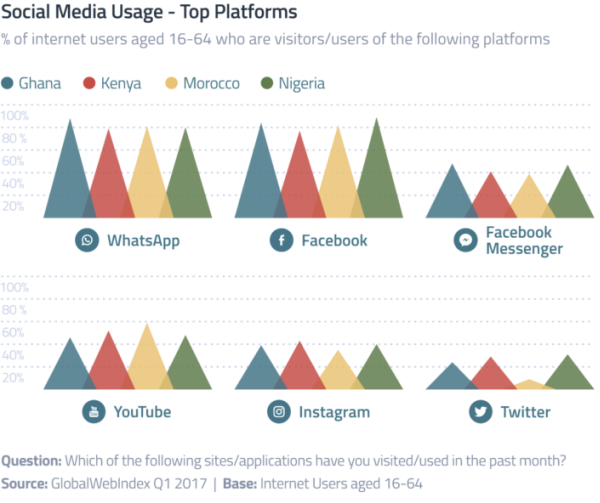

Social media activities of digital consumers in markets such as Ghana, Kenya, Morocco and Nigeria shows a dominance of Facebook platforms.

Important to note here is that social networkers in these countries display a slightly different attitude to their social media portfolio than many other internet users around the world – using fewer platforms, for longer and in a more active/engaged way.

This runs counter to the passive networking trend seen elsewhere, where social networkers are becoming more selective about where they share their personal content and more likely to browse content on social platforms, rather than contribute.

Facebook and WhatsApp form the core of digital consumers’ social media portfolios, with usage of these apps almost universal. Most of Facebook’s competitors, most notably YouTube and Twitter, post much lower figures in this market than is usually seen around the world. Only about half of internet users are visiting YouTube, whereas this platform can boast more visitors than Facebook in most markets.

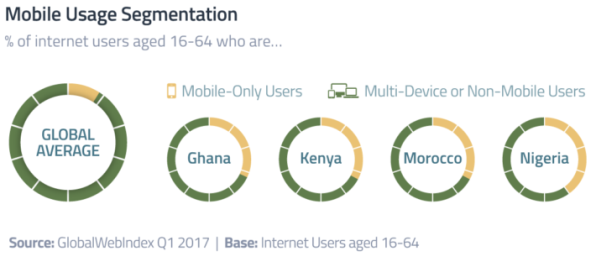

40% Of Digital Consumers In Nigeria Are Mobile-Only

PCs and laptops are much less important to digital consumers in Ghana, Kenya, Morocco and Nigeria. It’s apparent that the digital lives of internet users in these markets revolve around mobiles. Across all 40 countries where GWI conducts its research, it’s only 9 percent of internet users who can be classified as truly mobile-only, not accessing or owning any other connected device. In these four countries, however, figures rise to over a third. Nigeria leads the way, with 40 percent of digital consumers falling into the mobile-only audience.

This is testament to the importance of mobile in the development of the internet landscape in these countries. While most digital consumers across the globe, particularly in Europe and North America, first came online via computers, it’s smartphones that are clearly seen as the default internet device for consumers in many emerging markets.

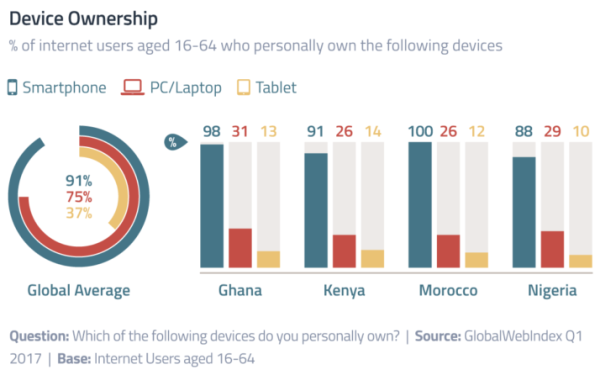

Only 26% Of Internet Users In Morocco Own PC/Laptop

One of the most striking differences in device usage between these markets and the global picture is the minor role played by PCs and laptops.

Similarly, while tablets are close to being mainstream devices in many of our other markets, here they are a niche device. In both these instances, the importance of mobiles and the advanced functionalities of modern smartphones mean we are unlikely to see ownership rates for other devices in these countries grow in the future.

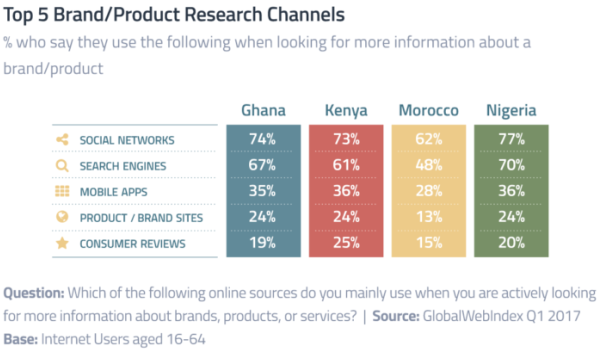

Social Most Important Product Research Channel In Kenya

At the brand discovery phase, GWI finds that while more ‘traditional’ channels, particularly TV, still have an important role to play in how consumers discover new products or services, the importance of digital is plain to see.

Also compared to the global average, one of the biggest over-indexes in Ghana, Kenya and Nigeria is for discovering new brands via social media.

At the next stage of the purchase journey – the research phase – social media emerges as key. When consumers in these markets are aware of a brand or product and are looking for more information, they are most likely to turn to social media. Considering how highly-engaged digital consumers are with social media, particularly with Facebook, this does suggest that social commerce options could have a potential in these markets.

Already popular in some Asian markets, where smartphones are similarly central to consumers’ digital lives, social could become a key part of the growing ecommerce industry in emerging African markets.