Research conducted by the International Data Corporation (IDC) shows that there has been a recorded robust year-on-year growth in the final quarter of 2014 in the Middle East and Africa (MEA) tablet market. The same is being attributed to holiday purchases and aggressive end-of-year promotions which spurred a particularly strong performance in the consumer segment.

The research by the global advisory service firm showed that the overall MEA tablet market grew 26.1% year on year in Q4 2014 to total 4.43 million units, with the activities of several Far East manufacturers spurring significant annual growth in shipments of Android (33%) and Windows (131%) tablets.

“The telco channel experienced its highest ever rate of growth during the final quarter of 2014. There are a couple of reasons behind this growth – in South Africa, Vodacom, one of the biggest telecom operators in the country, introduced its own tablet and shipped approximately 170,000 units during the quarter, while in Turkey, local vendor Casper shipped around 100,000 tablets through the telco channel,” commented Victoria Mendes, a research analyst at IDC Middle East, Africa, and Turkey.

Year-on-year growth of 16% saw Samsung continue as the leading vendor in MEA, with the Korean giant shipping a total of 886,000 units to the region in Q4 2014. And despite suffering a decline of 11%, Apple retained second place in the market, with shipments totaling 580,000 units.

Lenovo remained in third position, but with year-on-year unit growth of 100% and volumes totaling 572,000 units for the quarter, the vendor is extremely likely to overtake Apple at some point during 2015, the report states.

Asus maintained its fourth position despite shipments falling 7% to 206,000 units, while Turkish vendor Casper increased its shipments 80% to 180,000 units on the back of strong growth in the consumer and education segments.

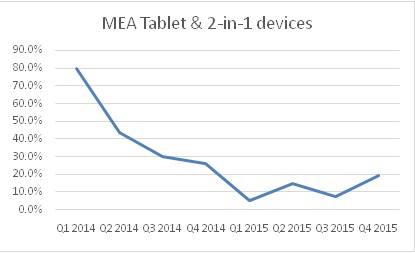

“Moving forward, the MEA tablet market is expected to see a significant slowdown in growth. This has become particularly evident since the start of the new year, with the MEA market set to experience its first ever quarter-on-quarter decline in Q1 2015 amid intensifying competition from smartphones and phablets. Nevertheless, the MEA tablet market is still forecast to post double-digit growth for 2015 as a whole, while other regions around the world will experience much bigger slowdowns or even declines. The consumer segment will remain the major contributor to this growth, but we also expect to see a huge contribution from the commercial segment in 2015, with education deals being a major driver,” Fouad Charakla, a research manager at IDC Middle East, Africa, and Turkey.