The Middle East and Africa (MEA) region struggles with the most complex set of challenges that can impact growth – both in the long term and the short term. No other region is braving the global economic challenges in the backdrop of a war-like situation. Unlike any other region, the biggest markets in MEA are still recuperating from overthrown regimes, revolutions that are not just about technology or business and Kingdoms that are striving hard to find newer ways of leading a whole generation into an unexplored future. Despite all odds, the region has shown continued resilience, year-after-year.

The will to fight, and remain in the race, has remained unchanged in 2016 too.

In the last few months, there was some good news for MEA as consumer confidence surveys from the likes of Nielsen and YouGov asserted that consumers are expecting the economy to look up in markets such as UAE, Egypt and Saudi Arabia – all growth engines for MEA. Depending on the forecast of choice however, the trend in advertising spends varied from decline to steady numbers to nominal growth. In what can be called mostly-opaque markets, where the walls created within make it difficult for any transparent or credible numbers, agency forecasts are the best bet to analyze, predict and plan for what lies ahead. Most of these numbers are based on resources in advertising, public relations, market research and specialist communication outfits. However, as the year draws to a close, and the region has access to various forecasts, one must understand that these numbers can at best be seen as benchmarks that need to be approached with caution.

BAD, BAD YEAR

Off record, most agencies and marketers have admitted that 2016 has been much tougher than originally estimated. The experience gained in the 2008 economy crash played a significant role in aiding strategies and preparedness to face the storm this year. On the one hand, this helped in avoiding knee-jerk reactions and hence there were lesser news of layoffs and more headlines of new hires, value addition in services and big campaigns during the likes of Ramadan and the sports season. On the other hand, some agencies revised numbers every week to ensure that they stayed strong on balance sheets and met projected targets. As the marketer demanded more from less, budgets were cut and ad spends were hit hard. In short, the year was bad – but true to the Arabian tales, there is light at the end of the tunnel.

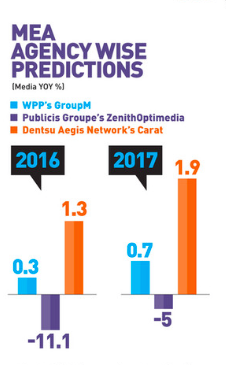

Perhaps the unhappiest numbers came earlier in the year in ZenithOptimedia’s Advertising Expenditure forecast. The Publicis Groupe agency predicted an 11.8 percent drop in ad spend in the region in 2016, followed by further declines of 7.3 percent in 2017 and 4.2 percent in 2018, averaging out at a 7.8 percent annual decline in 2018. This was especially tough given that the ZenithOptimedia forecast otherwise has positive numbers for every other region.

Perhaps the unhappiest numbers came earlier in the year in ZenithOptimedia’s Advertising Expenditure forecast. The Publicis Groupe agency predicted an 11.8 percent drop in ad spend in the region in 2016, followed by further declines of 7.3 percent in 2017 and 4.2 percent in 2018, averaging out at a 7.8 percent annual decline in 2018. This was especially tough given that the ZenithOptimedia forecast otherwise has positive numbers for every other region.

GroupM’s This Year, Next Year had slightly brighter forecasts. The WPP media holding company expects growth in MEA, with ad spends moderately increasing by 0.3 percent in 2016 and 0.7 percent in 2017.

Carat Ad Forecast report of March 2016 predicted MEA growth by 1.3 percent in 2016 and 1.9 percent in 2017 with growth by market in low single digits or declining. Nigel Morris, the CEO of Dentsu Aegis Network – Americas & EMEA even said in an interview with the Arabian Marketer that the agency network was seeing growth in the region. He said, “All things considered, you would have expected the region to be very depressed but it is not. Our businesses are growing and we continue to innovate. MEA has a lot going for it – a young population that is well educated, is digitally savvy and very social. We are realistically optimistic in our expectations. MEA has all characteristics of a digital economy that will show growth and development, and advertising follows overall economic development.”

THE DIGITAL ECONOMY

The light at the end of the tunnel comes in the form of the digital economy that MEA has been characterised into. By definition, a digital economy refers to an economy that is based on digital technologies. Also called the Internet Economy, the New Economy, or Web Economy, it is increasingly, intertwined with the traditional economy making a clear delineation harder. In MEA, this is true for various markets.

The Middle East, for instance, is one of the fastest growing regions in terms of internet usage with a growth rate of almost 400 percent over the past decade. Recent market reports show that people in the Middle East are rapidly embracing social media and online ecommerce platforms, and that smartphone penetration has leapt significantly over the past four years and exceeded 60 percent in many countries in the region. To date, growth seems to be primarily on the consumer side of the industry, but it will most likely have significant impact on the production side, stimulating more businesses to go online, thus generating more services and creating more jobs. According to Boston Consulting Group the digital economy, which contributed USD 2.3 trillion to GDP in the G-20 (the Group of 20 that includes Saudi Arabia) in 2010 and is expected to contribute more than USD 4 trillion to their GDP in 2016, is growing at 10 percent a year —significantly faster than the global economy as a whole. The growth in the digital economy is even higher in developing markets – 15 percent to 25 percent per year.

The Middle East, for instance, is one of the fastest growing regions in terms of internet usage with a growth rate of almost 400 percent over the past decade. Recent market reports show that people in the Middle East are rapidly embracing social media and online ecommerce platforms, and that smartphone penetration has leapt significantly over the past four years and exceeded 60 percent in many countries in the region. To date, growth seems to be primarily on the consumer side of the industry, but it will most likely have significant impact on the production side, stimulating more businesses to go online, thus generating more services and creating more jobs. According to Boston Consulting Group the digital economy, which contributed USD 2.3 trillion to GDP in the G-20 (the Group of 20 that includes Saudi Arabia) in 2010 and is expected to contribute more than USD 4 trillion to their GDP in 2016, is growing at 10 percent a year —significantly faster than the global economy as a whole. The growth in the digital economy is even higher in developing markets – 15 percent to 25 percent per year.

MEA is already seeing the impact of this in the rise of ecommerce and even mobile commerce in the year. A Global Web Index report shows that in October 2016, MEA was second only to the Asia Pacific in the transactions done via mobile phones for m-commerce.

SMALL STEPS, BIG LEAPS

While the online commerce trend has been strengthening, the focus to offer a seamless omnichannel experience is evident also in ensuring the right e-payment mechanisms. According to the State of Payment survey conducted by Payfort, 61 percent of the population across the Middle East shops online, with UAE leading the region at 71 percent. Marketers are growing their online presence, in an attempt to offer the best experience to their customers – from locating a purchase to finally transacting. The onus on the industry is to make the payment process secure and simpler.

The report highlights that Cash On Delivery (COD) is a popular payment option in the region at presence, with 50 percent of shoppers preferring COD. This is true especially in Egypt where 70 percent of shoppers cited it as the preferred method.

While 26 percent prefer paying online with credit cards, there is still a noticeable gap and a challenge to bring about secure payments options to attract customers to transact online. In many ways, mobile has emerged as a solution here.

Aaron Oliver, Head of Emerging Payments, MasterCard MEA explains how mobile payment is the way forward. “Earlier it was one of the biggest challenges but now mobile is the way people shop first. Consumers are looking to buy on their way home, in the car, essentially on the go.” Mr Oliver elaborated that the possibilities of conversions is growing exponentially as more people are on devices and with the likes of Amazon building a trusted online community. “There is Apple Pay, Android Pay and Samsung Pay among others who are trying to be make payments easier. We need to take advantage of technology and know how consumers can make payments in a secure and seamless way,” he said.

Aaron Oliver, Head of Emerging Payments, MasterCard MEA explains how mobile payment is the way forward. “Earlier it was one of the biggest challenges but now mobile is the way people shop first. Consumers are looking to buy on their way home, in the car, essentially on the go.” Mr Oliver elaborated that the possibilities of conversions is growing exponentially as more people are on devices and with the likes of Amazon building a trusted online community. “There is Apple Pay, Android Pay and Samsung Pay among others who are trying to be make payments easier. We need to take advantage of technology and know how consumers can make payments in a secure and seamless way,” he said.

THE DILEMMA, THE POTENTIAL

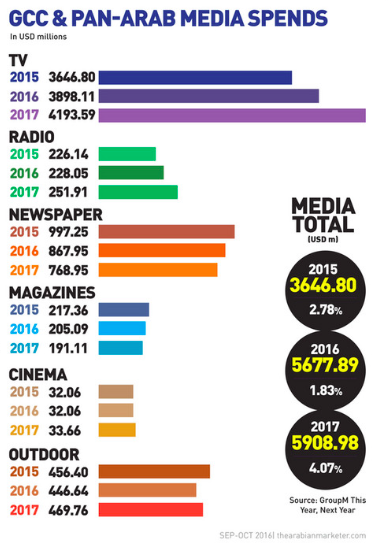

A truth about the MEA region is the advertiser partiality towards legacy media despite all growth trends in digital. Some of the forecasts did not even consider digital media spending in the region due to the miniscule nature of these numbers. The GroupM survey is a case in point. Even as Facebook and Google have predicted growth in MEA, it is not indicative in the ad forecasts. Let us consider the GCC and Pan Arab example.

The GCC countries aligned with the global expectations that the total advertising spending would rise from USD 2.493 billion in the first quarter of 2015 to USD 2.615 billion in 2016, up by 4.8 percent. The UAE topped the list of GCC countries, followed by Saudi Arabia. In the region, as ad investment is shifting across categories, newspapers and magazines are losing out to TV and radio. The trend is in line with expectations but misses out on any forecast factoring in digital. In that missing digital number, lies the opportunity.

Marketers cannot ignore the digital adoption for long. Lack of measurement may pose some significant challenges but the market will find a way of navigating these in its course of finding the consumer. MEA may be evoking fear in the minds of global leaders in terms of investments and expected growth, but the only way forward is growth and the biggest enabler is digital, irrespective of what the forecasts say.

This report was published in the Sep-Oct print issue of The Arabian Marketer.