Authored by Ahmad Abu Zannad, Regional Strategy Director & Raja Sowan, Regional MD, Arc MEA

We believe that everything that matters in our business simply starts and ends with two things — people and their behavior.

People live, work, play, eat, use, consume and shop. This article explores their shopping behavior so lets clarify upfront that:

1. Consumers USE products and services, whereas

2. Shoppers BUY products and services

If we observe today’s shoppers, on the surface, they all seem quite unremarkable. But if we look closely, we will get the feeling that shoppers in a retail environment are merely being herded like sheep! Retail environments, brands and communication tools seem to push people down a funnel, trying to get them to act in a predictable, pre-set manner.

If we observe today’s shoppers, on the surface, they all seem quite unremarkable. But if we look closely, we will get the feeling that shoppers in a retail environment are merely being herded like sheep! Retail environments, brands and communication tools seem to push people down a funnel, trying to get them to act in a predictable, pre-set manner.

This, we submit, is not the right approach to winning the hearts and minds of shoppers. What if, instead of ‘herding’ them, we ‘help’ them? But how do we reframe the conversation?

It is all about going back to basics and providing solutions that help people navigate their shopping journey. Today, more than ever before, people don’t differentiate between off-line, online, social and in-store. All of these different channels are part of their total shopping experience. If shoppers don’t differentiate, then neither should we as advertisers and marketers.

It is all about going back to basics and providing solutions that help people navigate their shopping journey. Today, more than ever before, people don’t differentiate between off-line, online, social and in-store. All of these different channels are part of their total shopping experience. If shoppers don’t differentiate, then neither should we as advertisers and marketers.

Changing the conversation requires us to understand the ecosystem within which our shopper exists. We refer to this modern-day ecosystem as meCommerce. In the meCommerce world, we need to develop programs that deliver a win to the shopper, to the Brand and to the Retailer. We need to reach out and meet shoppers where they are, and design our programs to meet their actual needs, no matter what the channel; because we live in a meCommerce world where shoppers are in control.

We could help people shop by answering three simple questions on:

1. What shoppers do

2. What shoppers want

3. What shoppers use

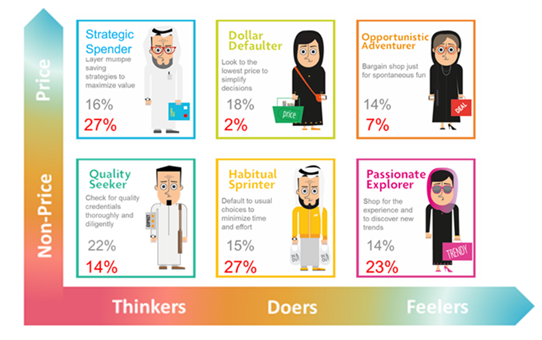

We captured this in a framework seen through the lens of the shopper and interpreted it into six different shopper archetypes that define their different shopping modes, their needs and the relevant touch points along their path to purchase.

In this framework lies the answer to different shoppers and different categories measured across different countries. The knowledge behind this framework is fueled by a large-scale ARC proprietary quantitative study, further qualified by in-depth qualitative studies. We call this study PeopleShop.

PeopleShop research data was compiled across more than 15,500 shoppers in nine markets around the world. It covered 27 product categories and 40 different touchpoints. It gauged 60 shopping attitudes and covered 22 shopping trips and modes, and uncovered 40 needs and motives.

PeopleShop highlights different behavior patterns of shopping modes, needs and touch points. By applying these patterns to a category, country or channel, we can learn more about shopper behavior, and communication that would help people shop better. Here are some learnings and insights that could be applied to the GCC region to not just help people shop better but also to fuel business growth.

Insight #1: Less About ‘Price’ and More About ‘Value’

Let us begin with an understanding of the way shopper’s think and act. The archetypal framework reflects the shoppers’ mindset and their behavior across different categories at different times. Depending on the category shopped, the same person can exhibit different archetype behaviors. The framework tracks motivation by trends (emotionally) and price (functionally):

Thinkers seek information to help validate decisions

Doers seek to minimize time and money spent

Feelers seek fun and pleasure from the experience

Unlike the West, shoppers in the GCC region are not price sensitive. More than six out of 10 shoppers prioritize emotional triggers during their path to purchase. A mere 2 percent of these shoppers base their purchase decision on lower prices, versus 18 percent of shoppers in the West.

A macro view of the different categories suggests that when it comes to “value shopping”, GCC shoppers tend to be “Strategic Spenders” rather than “Dollar Defaulters” or “Opportunistic Adventurers”. They neither shop strictly to find the lowest prices nor are the driven by a sense of achievement felt by bargaining for a lower prices. They shop to ensure that they are making the best purchase decision. As “Strategic Spenders”, they want to make a smart purchase decision, and “smart” is not necessarily “cheap”.

Shoppers in the GCC are ready and willing to pay the extra value as long as the shopping experience engages and inspires them to act and to buy.

We highly recommend that brands stop the value race to the bottom, in which price becomes the weapon of choice, and start working towards developing experiential shopping journeys that delight their shoppers and engage them.

Insight #2: Meeting the multi-faceted needs of GCC Shoppers

The other shopper behavior in our region has to do with the touch points our shoppers consume along their path to purchase to help them make better informed purchase decisions.

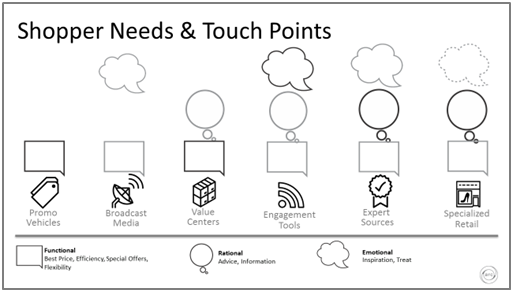

These touch points range from traditional mass media to traditional online spaces (websites, ecommerce sites) to one-on-one communication tools (e-mails, word of mouth) to engagement tools (social media, review sites, blogs) to brick and mortar.

Shoppers have specific needs along their path to purchase and they address their needs by interacting with a variety of touch points that are related to the category in which they are shopping.

We cluster these needs into three buckets:

Functional,

Rational, and

Emotional.

We then cross reference these needs with the 40+ touch points that we group into seven distinct categories.

Today, the majority of brand support and communication spends in the GCC, and around the world, are focused around three touch point categories that primarily deliver on the functional dimension, but barely touch on the rational and emotional dimensions to help inspire and motivate the shopper to switch off from their auto-pilot shopping modes. These are mostly singular touch points that narrowly deliver on the shoppers’ needs and there is little effort and money put behind establishing dialogs with shoppers and engaging with them.

The research from PeopleShop concludes that three out of 10 shoppers in the GCC region fulfill their rational and emotional shopper needs by engaging in digital and social spaces.

In a social-media fueled recommendation culture, shoppers are seeking to engage with brands, build emotional connections, forge mutually-beneficial relationships, and be part of a community where they might be inspired, entertained and discover connection.

In conclusion, shopping happens anywhere.

We live in a brave new meCommerce world where shoppers are in control. A world where the physical, digital, mobile, and social dimensions are no longer separated. Thanks to technology, shopping can, and does, happen anywhere.

However, technology should never be used as a gimmick. It should be used to enrich experiences, to connect at a human level, to build brands and ultimately, to move people to buy.