The advertising industry can look forward to a good year globally. The Middle East and North Africa (MENA) region however will have to brace for challenges.

The global ad market is on course for 4.6 percent growth this year, up from 3.9 percent growth last year, according to ZenithOptimedia’s new Advertising Expenditure Forecasts. Global advertising expenditure will total USD 579 billion in 2016, and will exceed USD 600 billion in 2017, reaching USD 603 billion by the end of the year.

Given that 2016 is a ‘quadrennial’ year, when ad expenditure is boosted by the Summer Olympics, the US presidential election and the UEFA football championship in Europe, will keep the year busy.

The global economy will however face clear challenges including the ongoing slowdown in China, and recession in Brazil and Russia, the humanitarian disaster originating in Syria and uncertainty over the future of the European Union. The advertisers’ confidence has remained largely unshaken, and Zenith’s forecast for global growth in 2016 has barely changed since it published its last forecasts in December 2015. There are three main reasons contributing to this ––– special events, rapid recovery from the markets most affected by the eurozone crisis, and the emergence of rapidly growing markets that are now opening up to international advertising.

Tough Year For MENA

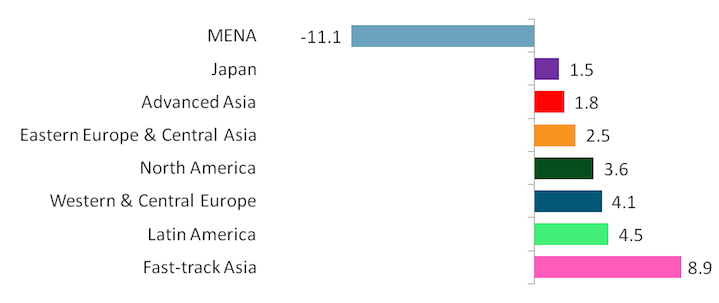

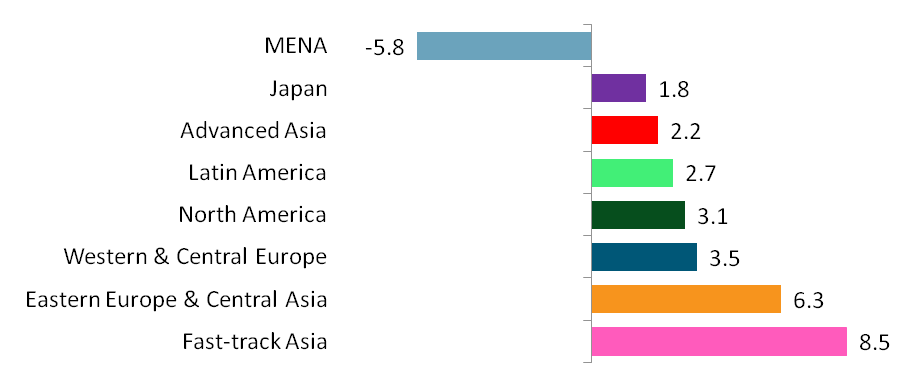

The prediction is however not very good for the MENA region. The drop in oil prices in 2014 has had a severe effect on the economies in MENA, and has prompted advertisers to cut back budgets in anticipation of lower consumer demand. Political turmoil and conflict have further shaken advertisers’ confidence in the region, according to Zenith. The agency has forecast an 11.1 percent drop in ad spend in MENA this year, followed by further declines of 5 percent in 2017 and 1.1 percent in 2018, averaging out at a 5.8 percent annual decline to 2018.

MENA is the only regional bloc, where Zenith is expecting decline of this nature.

However, ZenithOptimedia has identified ‘30 Rising Media Markets’ with long-term potential for rapid growth, and these include 16 in Africa and Iran from the Middle East. Many smaller advertising markets are now opening up to international advertising, and have the potential to growth at double-digit rates for many years to come. Zenith estimates that advertising expenditure across these 30 markets totalled USD 7.7bn in 2015.

The economies of these markets are growing rapidly, and their advertising markets are growing even faster. The advertising expenditure in these 30 markets is expected to grow at an average rate of 15 percent a year between 2015 and 2018 – more than three times faster than global average – and to increase by USD 3.9 billion to USD 11.6 billion. Advertising accounted for 0.37 percent of GDP across these 30 markets in 2015, well below the global average of 0.70%, highlighting their long-term growth potential.

Internet & Mobile Growth To Continue Globally

Globally, internet advertising is the main driver of global ad spend growth. Zenith expects internet advertising as a whole to grow at more than three times the global average rate this year – by 15.7 percent, driven by social media (31.9 percent), online video (22.4 percent) and paid search (15.7 percent). Internet advertising’s growth rate is slowing as it matures (it was 21.1 percent in 2014), but is expected to remain in double digits for the rest of the forecast period.

The great majority of new internet advertising is targeted at mobile devices, thanks to mobile’s widespread adoption and its ever-tighter integration into consumers’ daily lives. Zenith forecasts that mobile advertising expenditure will increase by USD 64 billion between 2015 and 2018, growing by 128 percent and accounting for 92 percent of new advertising dollars added to the global market over these years.

“Rapid growth from countries that are relatively new to the international advertising market, combined with a resurgence of established markets that were damaged by the financial crisis, will keep the global ad market on track for healthy growth for at least the next few years,” said Jonathan Barnard, Head of Forecasting at ZenithOptimedia.